nj property tax relief fund 2020

The rebate amount is equal to the tax paid after credits line 50 up to a maximum amount of 500. The loan will be non.

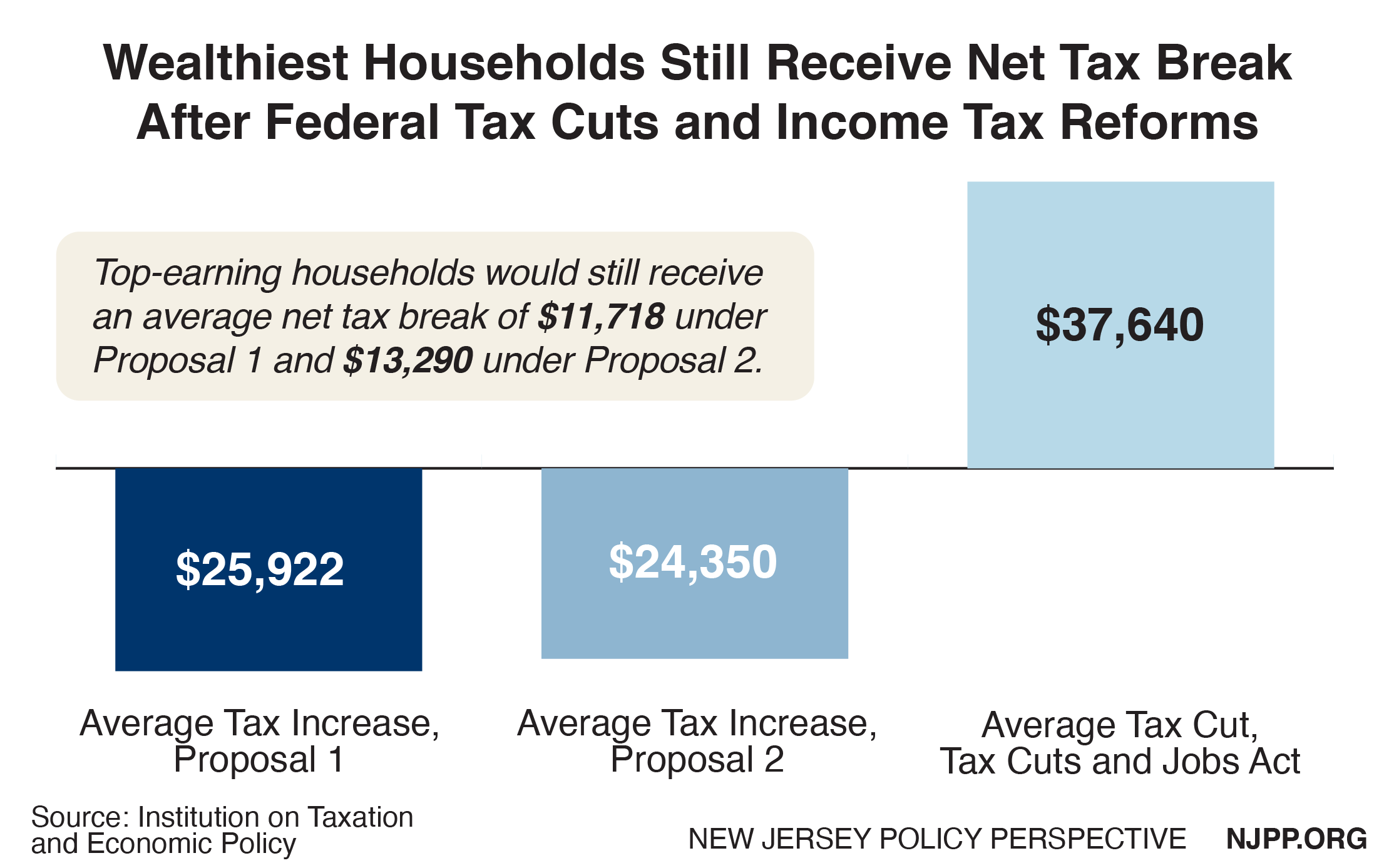

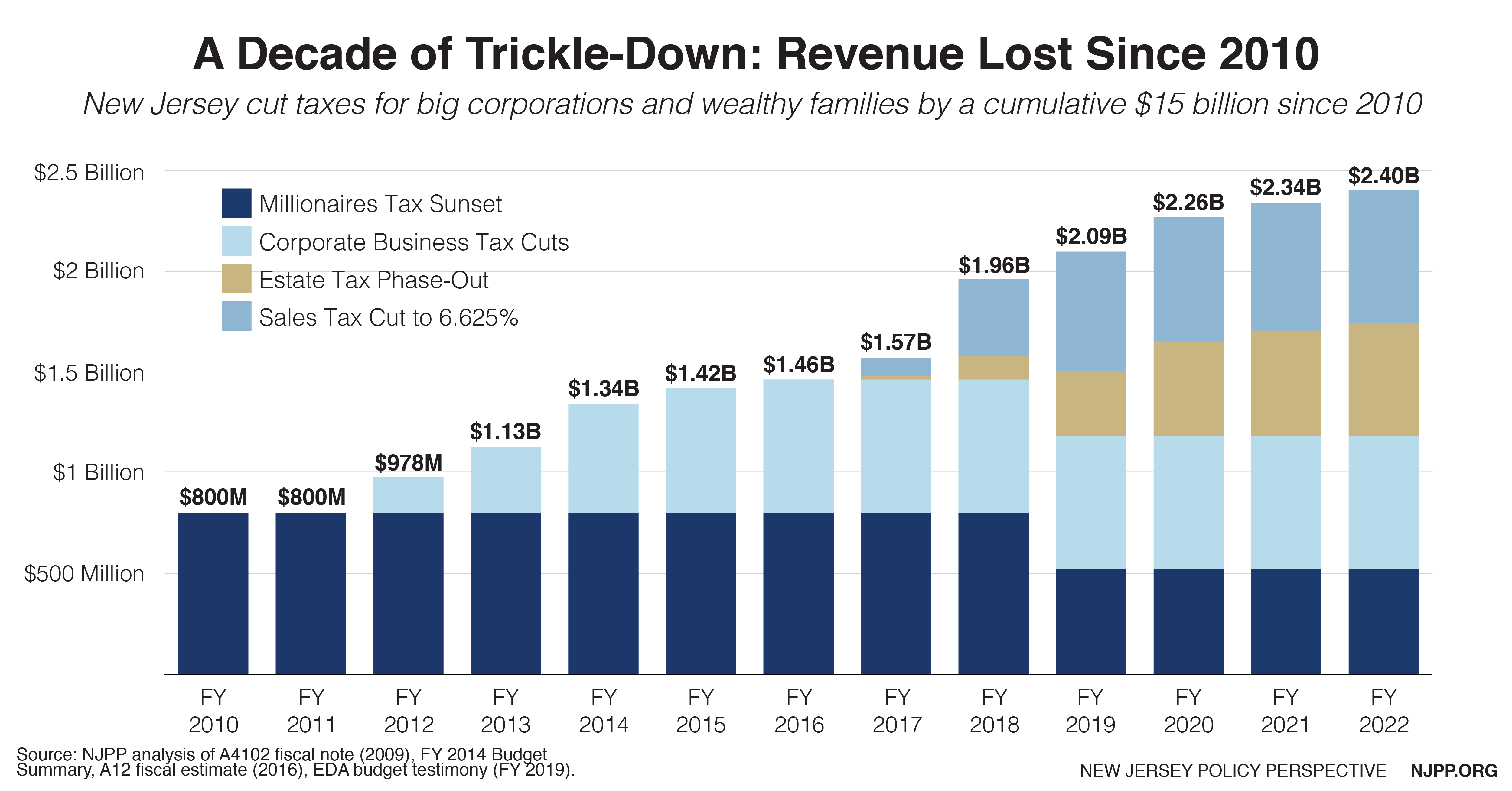

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Check Your Eligibility Today.

. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Homeowners making up to 250000 per year may. More Information For more information call.

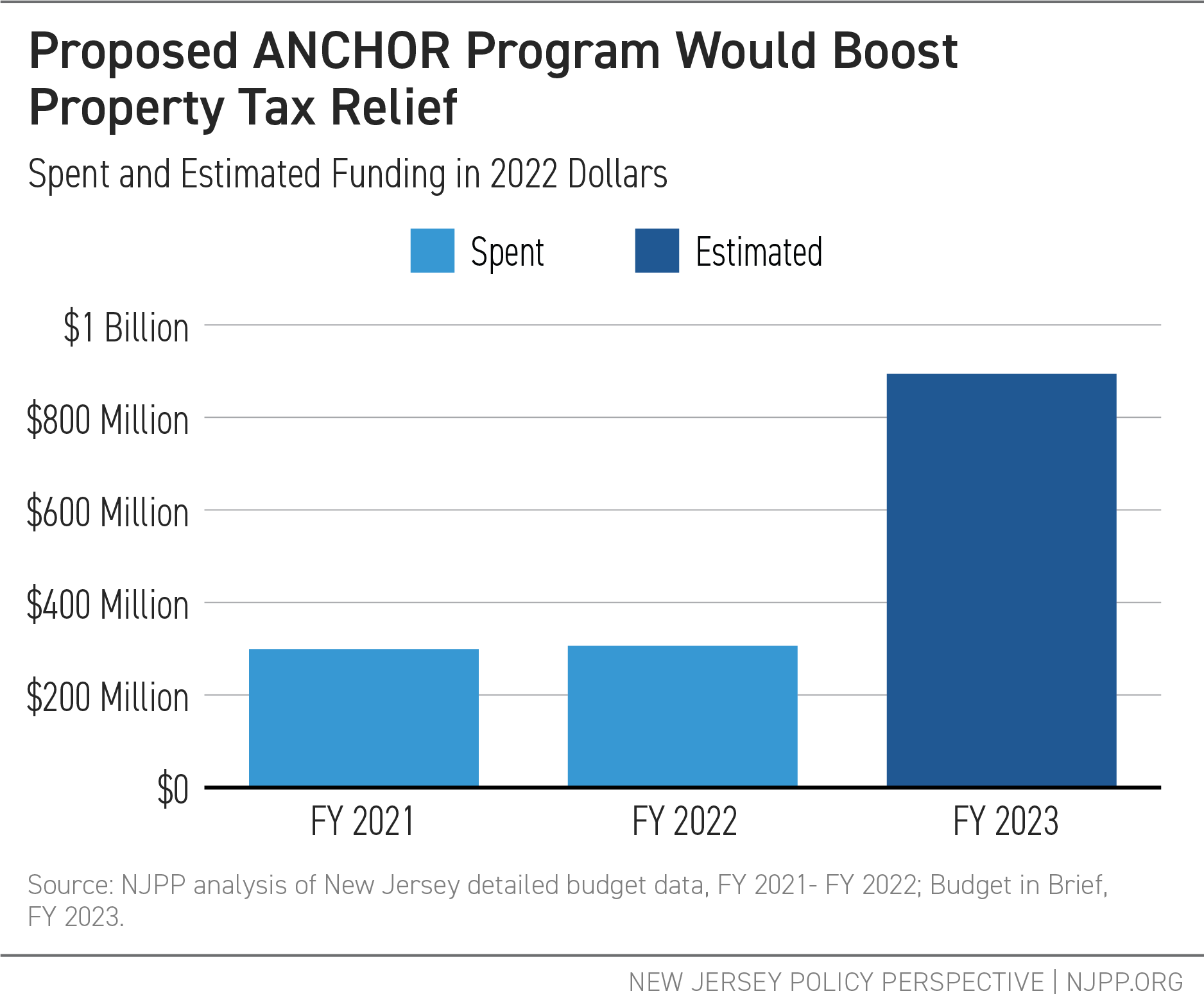

Nearly 18 million homeowners and renters would get property tax rebates averaging 700 next year under a new plan Gov. TRENTON - The Department of the Treasury today reported that March revenue collections for the major taxes totaled 1888 billion up 663 million or 36 percent above last. Thats occurred as the size of the average New Jersey property-tax bill has risen by nearly 20 over the past decade from 7576 in 2010 to 8953 in 2019 according to.

NJ Division of Taxation - Local Property Tax Relief Programs. Stay up to date on vaccine information. Property Tax Reimbursement Property Tax Reimbursement Eligibility Guidelines Age 65older or Receiving Social Security Disability By 123116 Lived in New Jersey for 10 Years Since.

NJ Rev Stat 54A9-25 2020. Proceeds from spousescivil union partners life insurance. NJ Mortgage Property Tax Relief Program Coming Amid COVID - Princeton NJ - Emergency Rescue Mortgage Assistance program will give up to 35000 to those who have.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. To qualify your mortgage or other housing costs must not have been delinquent before January 21 2020. Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023.

New Jersey Gov. December collections for the Gross Income Tax GIT which is dedicated to the Property Tax Relief Fund totaled 1611 billion up 1189 million or 80 percent above last. Call NJPIES Call Center.

Property taxes must be paid in full for the years applied for by June 1st of the following year. 18 of your rent is used to calculate your share of property tax 6 level 1 trekologer 4m Per the state constitution Article VIII Section I. Phil Murphy unveiled Thursday.

New Jersey homeowners struggling to pay their mortgage or property taxes can apply for up to 35000 in aid when the state opens its application portal on Feb. The up to 35000 payment would come in the form of a three-year. Beginning with tax year 2020 the Middle Class Tax Rebate will be issued to eligible New Jersey residents that file a 2020 resident Income Tax return NJ-1040 with a balance of tax.

Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits. Senior and disabled homeowners with income below 150000 average receive 534 benefits and other eligible homeowners with less than 75000 receive an average of. Renters can qualify for like 50 of property tax relief.

Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits. Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check. Im proud to say that three of the five lowest property tax increase ever.

The Garden State is home to the highest levies on property in the nation with a mean effective property tax rate of 221 according to the Tax Foundation. Property Tax Deduction for Senior Citizens and Disabled Persons You may qualify for an annual 250 property tax deduction for senior citizens and people with disabilities if you. In New Jersey localities can give.

Through the program up to 35000 will be provided to homeowners in the form of a three-year loan on a 0 percent interest rate with no monthly payments. That means if the amount on line 50 is less than 500 you will receive a. Income requirements are set by the State annually.

Capital gains on the sale of a principal residence of up to 250000 if single and up to 500000 if marriedcivil union couple. 2021 Senior Freeze Applications We will begin mailing 2021. All property tax relief program information provided here is based on current law and is subject to change.

The rebates will be hitting the mail as soon as July 1 sending 500 to over 750000 New Jersey families. COVID-19 is still active. Mortgage Relief Program is Giving 3708 Back to Homeowners.

2020 New Jersey Revised Statutes Title 54A - New Jersey Gross Income Tax Act Section 54A9-25 - Property Tax Relief Fund.

Nj Property Tax Relief Program Updates Access Wealth

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Nj Renters In Line For Some Needed Tax Relief Nj Spotlight News

The Official Website Of City Of Union City Nj Tax Department

Murphy Announces New Property Tax Relief Program Whyy

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

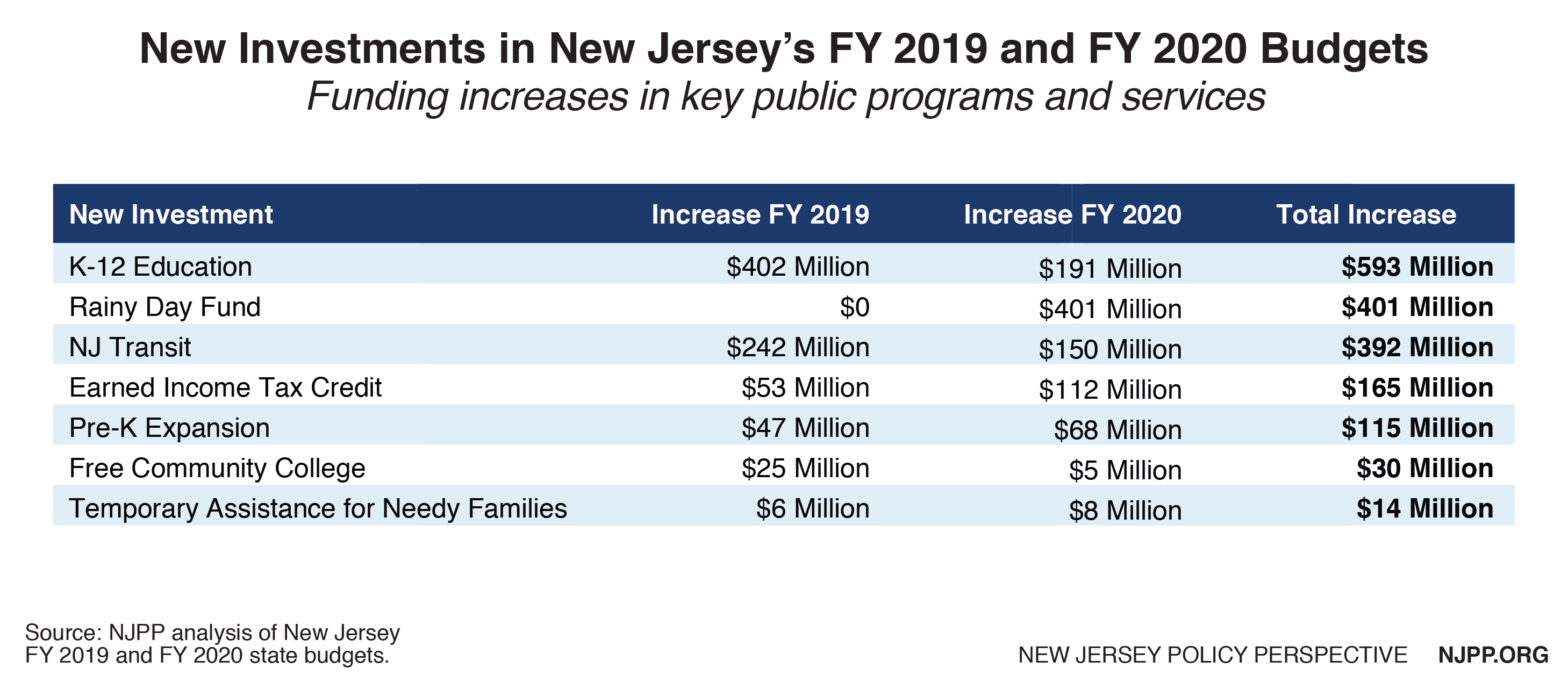

The Covid 19 Crisis Proves The Point New Jersey Needs More Revenue To Support Workers Families And Businesses New Jersey Policy Perspective

Deducting Property Taxes H R Block

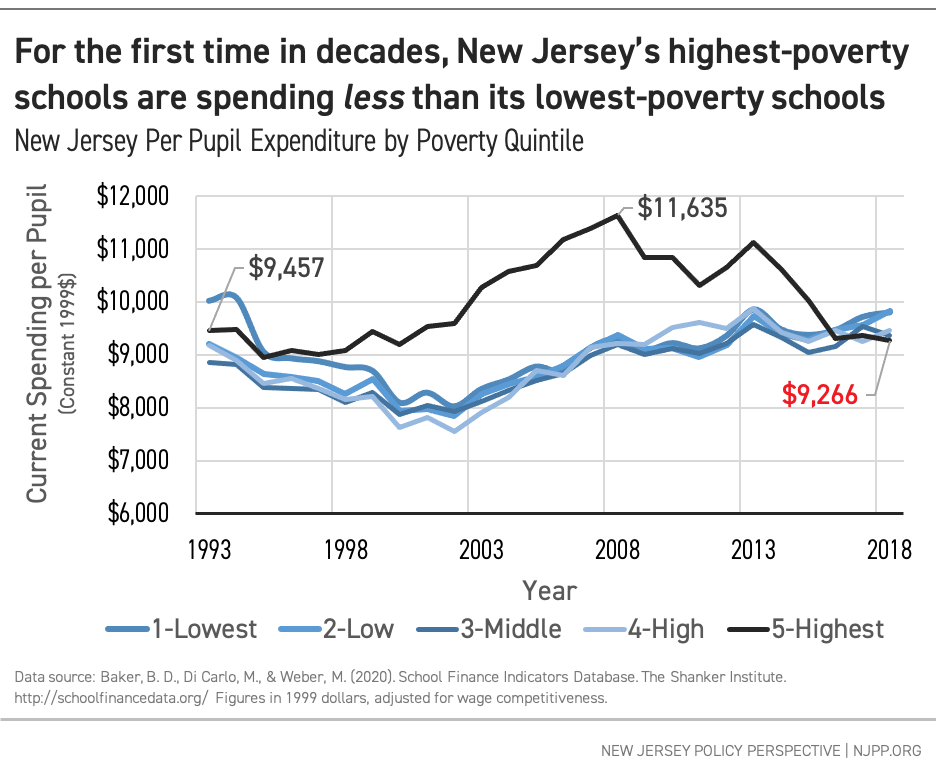

School Funding In New Jersey A Fair Future For All New Jersey Policy Perspective

State Local Property Tax Collections Per Capita Tax Foundation

The Covid 19 Crisis Proves The Point New Jersey Needs More Revenue To Support Workers Families And Businesses New Jersey Policy Perspective

Report Archives New Jersey Policy Perspective

Tax Assessor Township Of Franklin Nj

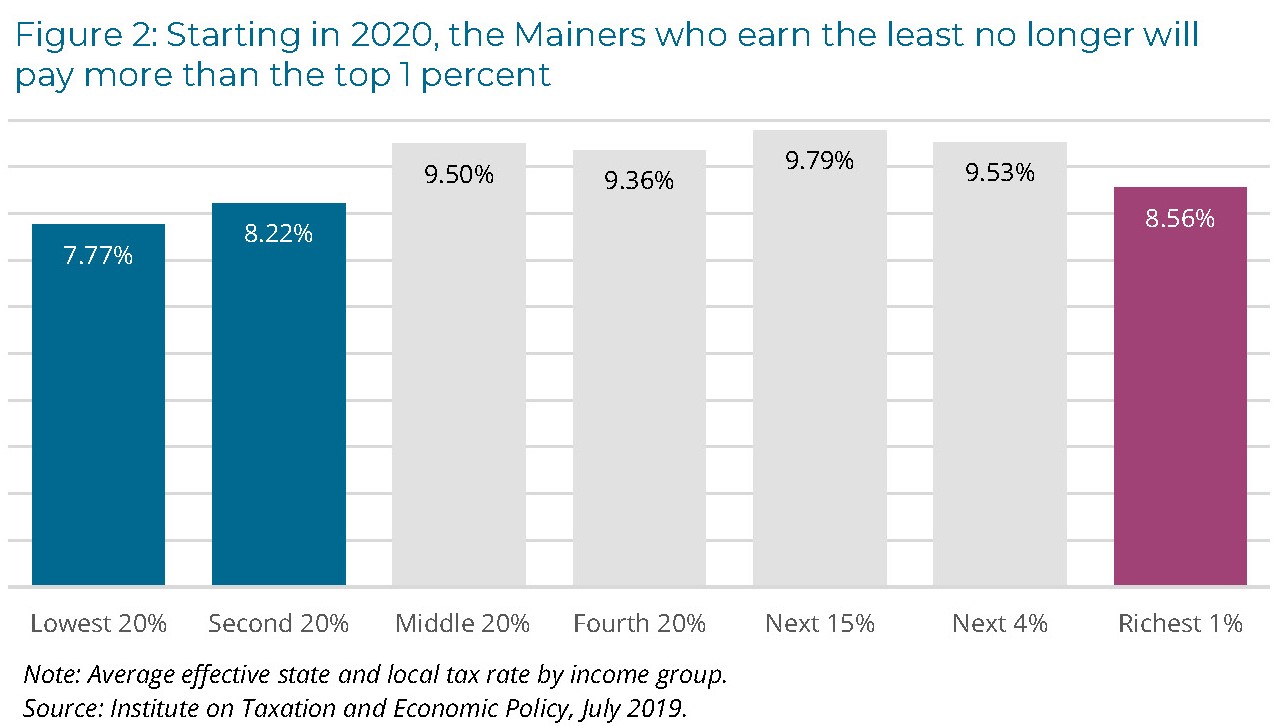

Maine Reaches Tax Fairness Milestone Itep

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Murphy S Property Tax Rebate Proposal Adds Renters Video Nj Spotlight News

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com